Investor Framework for Biodiversity Risk Mitigation

Suggested citation: Wassénius, E., Funke, H., Crona, B., Meacham, M. 2025. INFORM: Investor Framework for Biodiversity Risk Mitigation. Mistra FinBio & Stockholm Resilience Centre.

Read the full report below or by downloading the report here.

General disclaimer

The content and suggestions in this report are intended solely as general informational use and guidance. For any decisions that have financial impacts readers are encouraged to make their own assessments and consult with qualified advisors before taking any actions based on the material provided.

Although considerable care has been taken to ensure the information is accurate and dependable, no guarantees—explicit or implied—are made about its completeness, precision, or relevance to any specific situation. Neither the authors, nor the Mistra FinBio Programme accept responsibility for any inaccuracies, omissions, or outcomes resulting from the use of this report.

About INFORM

Urgent action is needed to stop the ongoing environmental degradation of our planet. As ecosystems face increasing pressures, it is crucial for businesses to recognize and address their impacts on nature. Integrating nature into decision-making is essential for sustaining both natural and financial capital, and investors play an important role in guiding companies toward sustainable business practices.

INFORM provides a science-based framework for investors to monitor and assess portfolio companies’ environmental performance, with specific focus on nature and biodiversity. It is designed to increase competency around this topic among engagement officers and companies alike. By linking the guidance to existing targets and frameworks, it is also designed to support investors, engagement officers, and companies as they journey towards the necessary shift in sustainability information disclosure needed for emerging reporting requirements and for more accurately assessing nature- and biodiversity-related risks.

2. Why Should Investors Use INFORM?

There are several initiatives launched to encourage and track company political engagement and commitments to sustainability-related targets, such as Spring and the Nature Action 100 company benchmark. So, what does INFORM add?

INFORM provides a more detailed focus that aims to help investors, and specifically engagement officers, guide and support companies as they move from making commitments to mapping their biodiversity impact and developing mitigative actions to reach committed targets. This is a key step in risk mitigation and for achieving the long-term investor interest of addressing systemic risks, as outlined by PRI. INFORM thus complements Spring and the NA 100 company benchmark by helping users gain a comprehensive understanding of companies’ interface with nature while also facilitating companies’ alignment with global requirements and disclosure standards.

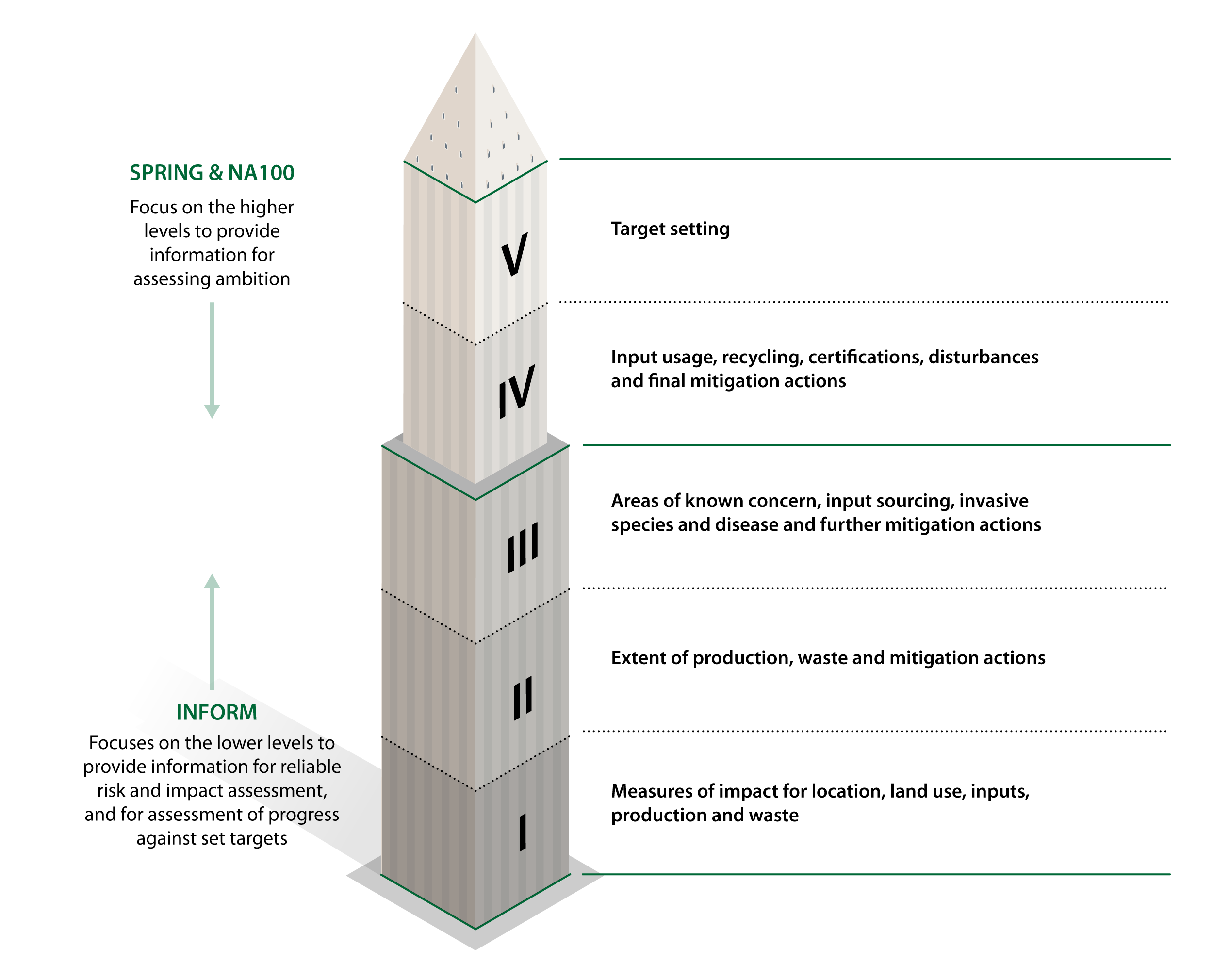

The engagement questions outlined in INFORM are categorized in five levels to help investors prioritize what issues to focus on during engagement (Figure 1). Lower levels focus on information that is critical to assess nature-related impacts and progress towards targets. Higher levels focus on information on targets and ambitions, thus deliberately overlapping with NA 100 and Spring to ensure information gathered from INFORM can be mapped to targets and to promote alignment.

To account for varying maturity in nature-related issues among companies and investors we outlined two ways to use the framework; one for Entry-level users and one for Advanced users. Entry-level users can use INFORM to increase their own (and companies’) understanding of biodiversity impacts and their importance for target setting and risk assessment. Advanced users can use INFORM as a detailed support for driving transformation in their portfolio companies.

Want to understand how to use INFORM? See Section 5 for detailed guidance

Want to learn more about nature, biodiversity, and its relation to systemic risk? See Section 3

Figure 1. The five levels of INFORM engagement questions and the information they focus on. Levels IV and V partially overlap with SPRING, the NA 100 benchmark and frameworks that focus on target setting and publicly made commitments.

3. Nature, Biodiversity, and Its Relation to Systemic Risk

Nature encompasses all living and non-living things in the environment, including the soil, minerals, water and glaciers. Biodiversity, on the other hand, refers specifically to the variety and variability of all living things. Biodiversity is directly affected by the pressures human activities put on the environment, particularly the amount of land and water we use, release of pollutants or invasive species, and of course climate change.

Almost 15 years ago, scientists created a framework called “planetary boundaries” to estimate limits for nine environmental dimensions. If human pressures push us beyond these limits our climate and living ecosystems risk becoming unpredictable and change so much that they could cease to provide the goods and services that underpin our economies and wellbeing.1 Therefore, understanding the magnitude of environmental pressures of companies is important because these environmental impacts translate into tangible risks to companies, investors and society.

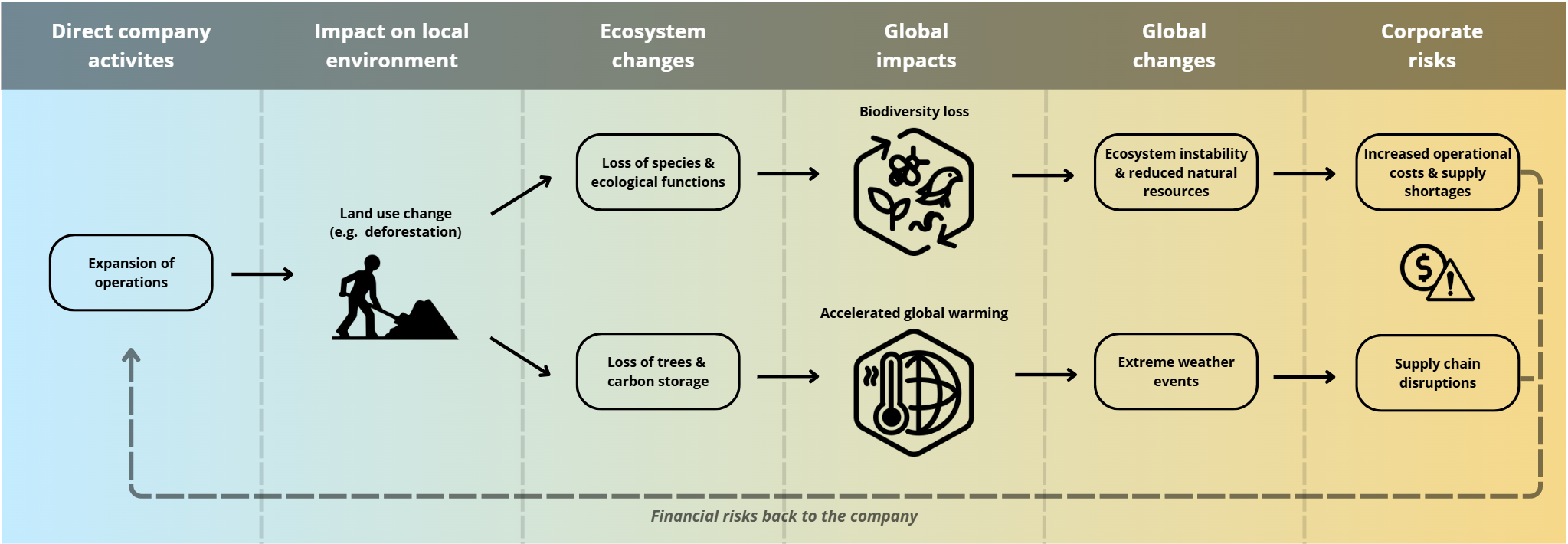

Figure 2. An example of how business activities may have global implications that lead to increased financial risk. Note that this is merely one example, and many other impact-to-risk pathways exist.

Systemic risk refers to disruptions that can destabilize markets, economies, and the entire financial system. Systemic risks that relate to the environment include climate change, and rapid fundamental change of ecosystems caused by biodiversity loss (Figure 1). Each can have far-reaching impacts on the economy and financial markets. For example, climate change can lead to extreme weather events that disrupt supply chains, damage infrastructure, and reduce agricultural productivity, all of which can negatively affect investment returns. Changing land use can affect the capacity of an ecosystem to produce agricultural or forestry products and lead to a loss of biodiversity that reduces the capacity of nature to mitigate and absorb shocks from the increasingly volatile climate, this translates into risks for economic assets.

Our climate is already changing. Extreme weather events have risen sharply in frequency and intensity throughout the world. Loss of crop production due to declining pollination, or the ability to maintain stable water flows in rivers both during drought and floods are severely compromised in many regions.2,3 In other words, the climate and nature-related risks and concomitant costs to businesses and society are already materializing.4,5 Therefore, understanding how companies can reduce their impact (or that of their supply chains) is a key part of reducing their own risk, and the likelihood of systemic risk.

Systemic risk requires a systems perspective on sustainability. This means understanding that the various components of our environment, society, and economy are interconnected and influence each other. A systems perspective emphasizes that actions in one area can have ripple effects across the entire system. The concept of planetary boundaries illustrates this well. For example, deforestation (which impacts the land-system change boundary) can lead to increased carbon dioxide levels since the trees no longer store any carbon in their trunks and also generally leads to loss of species, ecological functions, and even genetic diversity. As such, deforestation (or any land use change) has the potential to affect both climate and biodiversity. Interactions like the one described can amplify global warming and climate change, making it harder to maintain a stable and resilient Earth system.

4. The INFORM Approach to Engagement

The engagement process using INFORM is based on mapping out and assessing portfolio companies’ impacts on biodiversity by asking engagement questions.

To ensure that investors get information that is useful to assess a company’s interface with, and impacts on, nature questions are divided across a hierarchy of five levels. Following the hierarchy helps investors focus on the most critical information first. It supports both the investor and the company in gathering information that is relevant given their maturity regarding nature and biodiversity-related topics.

Level I questions are essential to reliably assess any company’s interface with nature since they account for the main drivers of biodiversity loss and impact from operational locations. To set the foundation to reduce biodiversity impact users should therefore focus on initially addressing Level I questions. Provided the company can address these, engagement can proceed to higher levels to plan mitigation actions and targets.

Engagement Questions

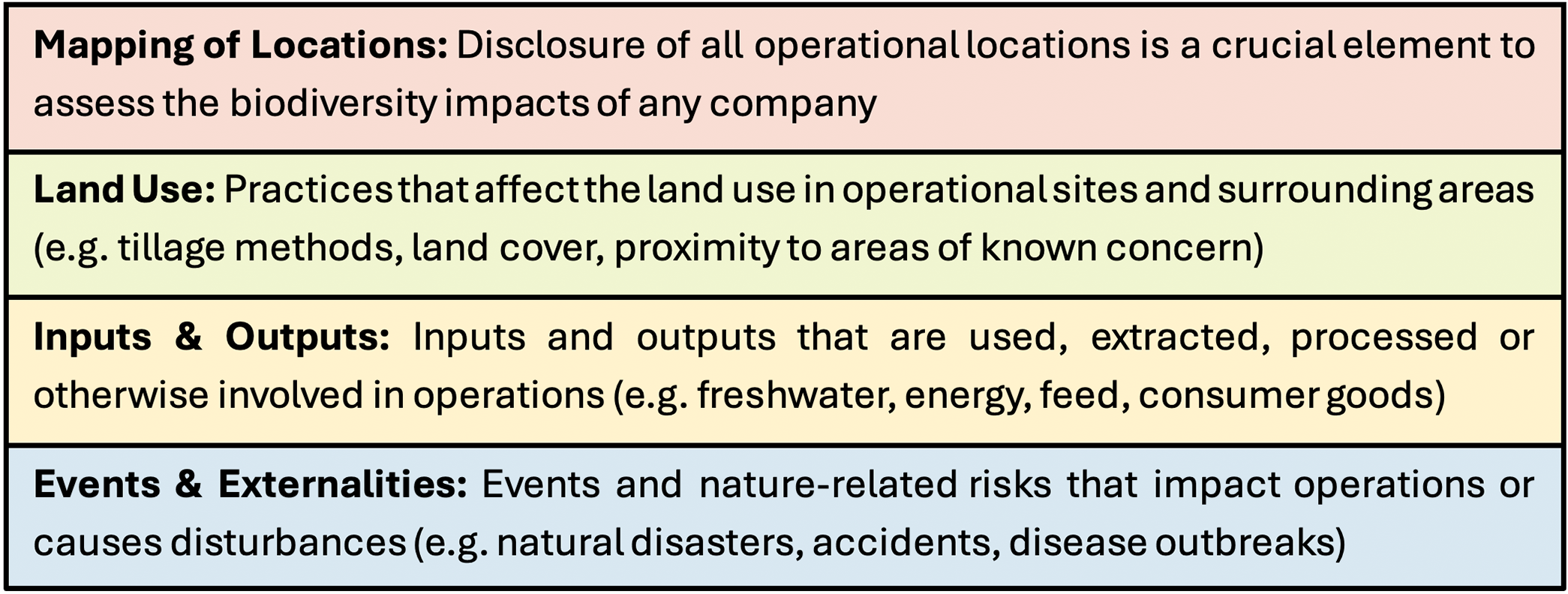

The engagement questions span four thematic areas, corresponding to key dimensions for assessing a company’s nature and biodiversity-related impacts. The thematic areas are grounded in environmental science which has identified information that is material to assess environmental impact (referred to as Essential Environmental Impact Variables).6 The four thematic areas are:

The first engagement question focuses on Mapping of Locations. This information is essential to make any reliable assessment of biodiversity impact. Remaining questions cover the three subsequent thematic areas, and all have at least one question for measurement of impact (I), mitigation action (A), and target setting (T).

- Measurement of impact (I) questions request information on processes that contribute to environmental impacts

- Mitigation action (A) questions request information on strategies or initiatives to mitigate environmental impacts

- Target setting (T) questions request information on what targets the company has set to reduce environmental impacts

Interpreting Responses

Users of INFORM must make subjective judgments to determine whether the company’s response to a question should be considered satisfactory or not, depending on the company’s maturity around these topics. However, for every question we provide guidance on its purpose and what should be included in an ideal satisfactory answer.

Simply by showing which engagement questions the company can address, investors will immediately gain valuable insights regarding the company’s reporting and understanding of nature-related impacts. For example, a company may have land use practices in place to mitigate environmental harm but have poor oversight of impacts from inputs in their operations. Such insights flag gaps or challenges that must be addressed for the company to improve their awareness of impacts. It can inform both the company and its investors regarding what actions to reduce impacts may need to be prioritized. The framework therefore helps investors work with companies to identify challenges and opportunities for action.

Sector-specific Guidance

All guidance in this document refers to general engagement questions that are broadly applicable to any sector (see General Engagement Questions-tab in the INFORM Spreadsheet). Users should however always be mindful of how the unique context of a company they engage with shapes its interface with nature. To aid this process we provide engagement questions specifically tailored to three sectors identified by NA 100 as high priority for reversing nature and biodiversity loss; Forestry, pulp and paper, Mining and metals, and Food and beverage retail.

Users will find these engagement questions in three sector-specific tabs in the INFORM Spreadsheet. These are based on the same questions as the general version, but with additional context for some questions and exclusion of the less relevant ones.

5. Different ways to use the INFORM?

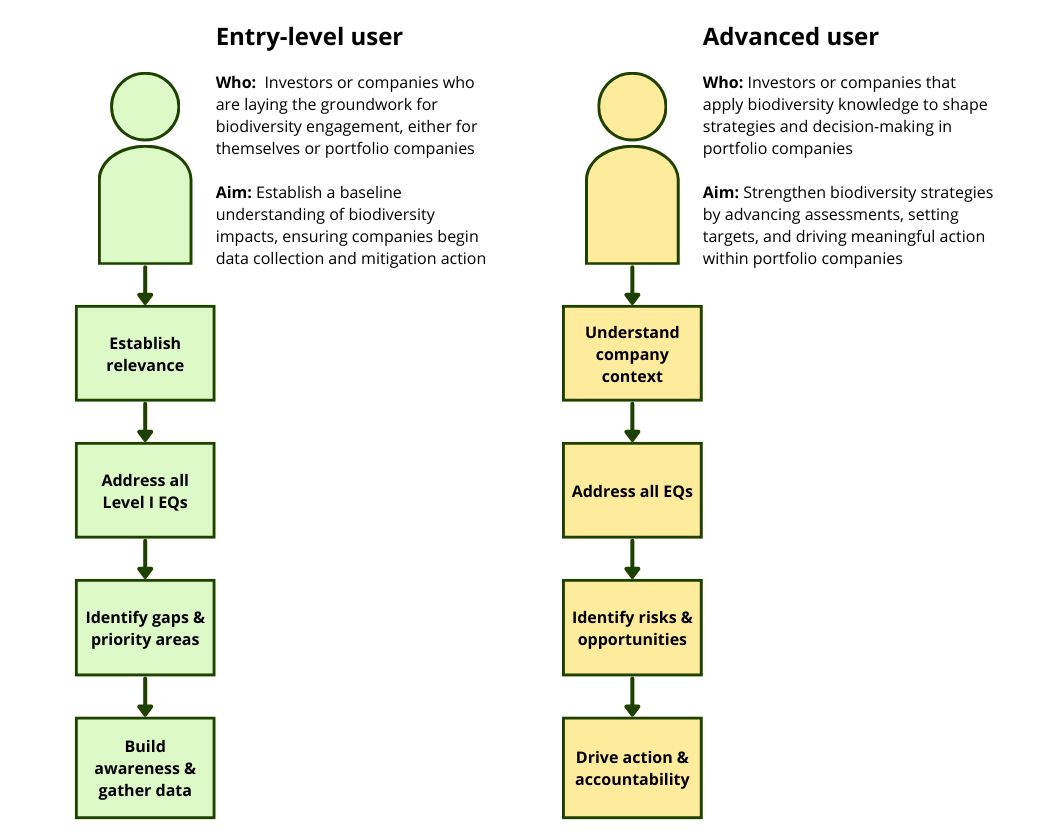

We outline two examples of how to make use of the guidance material: entry-level and advanced user. These two types should be understood as stereotyped users to illustrate different ways in which INFORM can support investors and companies (Figure 3). The goal of engagement will differ somewhat between these user types.

Detailed guidance for how each user type can engage with the material is found below.

Go directly to Engagement Process: Entry-level User

Go directly to Engagement Process: Advanced User

Figure 3. Archetypes for two different types of users

6. Engagement Process: Entry-level users

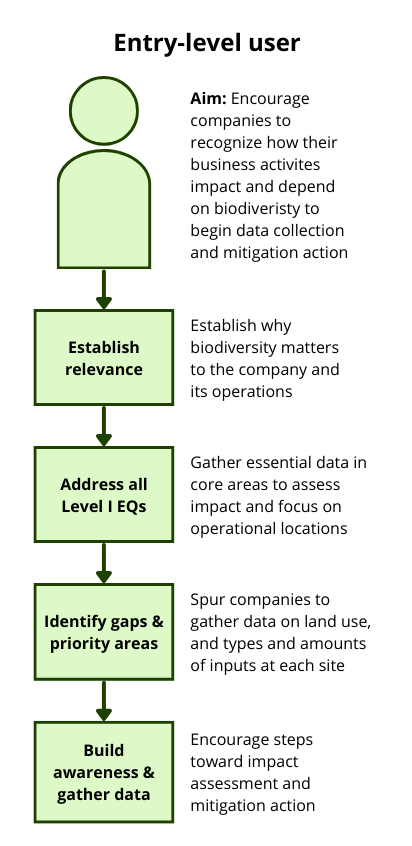

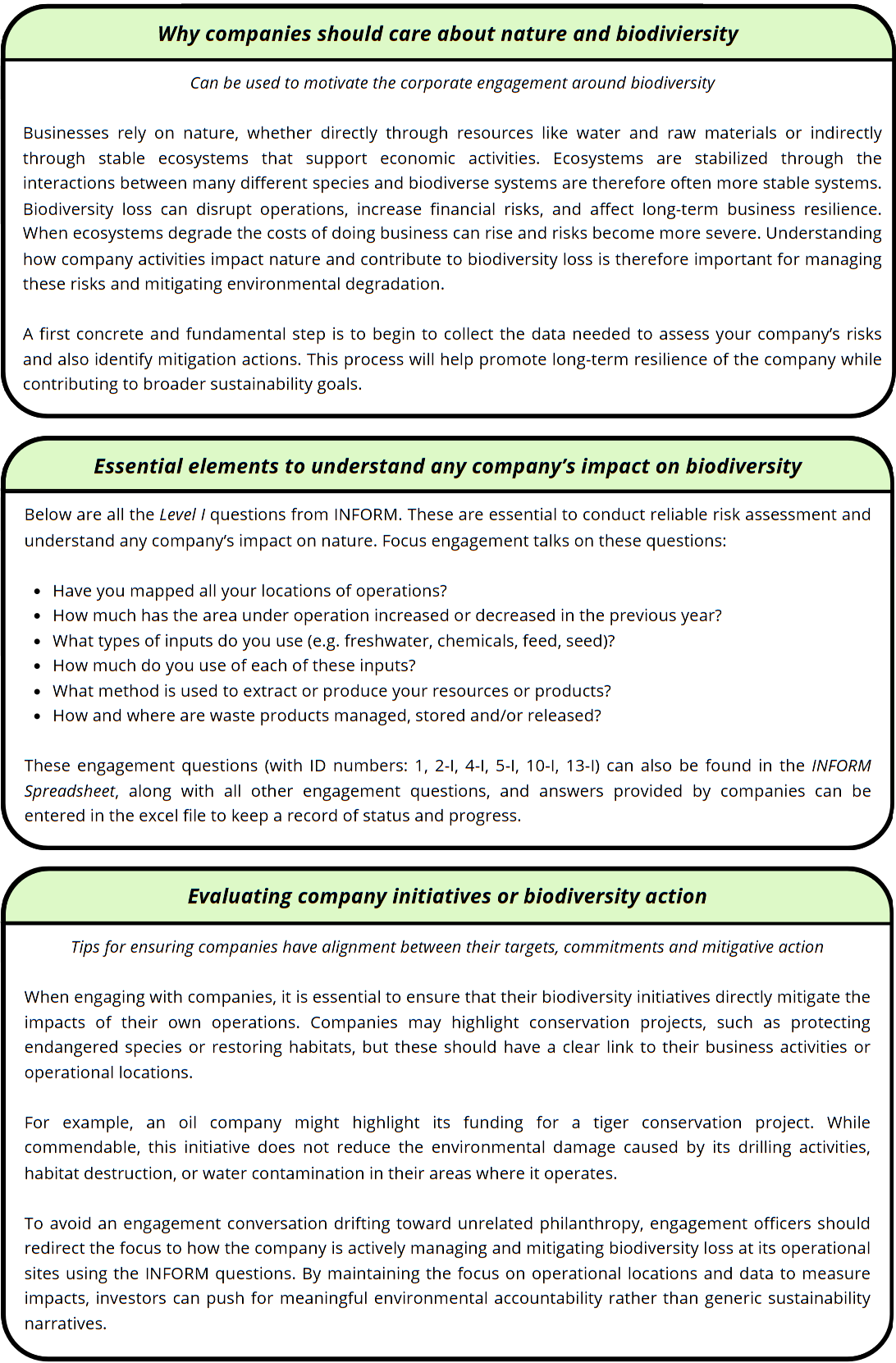

When engaging with companies that have low awareness of biodiversity impacts and nature-related risks, or if your own experience is limited, it is important to start at a foundational level. Companies with low topic maturity often lack the necessary data to assess their interactions with nature. Therefore, engagement should ideally begin by encouraging companies to recognize how their business activities depend on, and impact biodiversity (Figure 4). This initial step also helps companies begin the necessary journey towards collecting relevant data.

A primary focus should be on whether the company has mapped all its operational locations and is gathering data on land use, and types and amounts of inputs at each site. These elements are essential for reliable risk assessments and are covered by the Level I engagement questions.

Figure 4. Engagement process for entry-level users

The aim of entry-level engagement is not to address all questions, but to raise awareness regarding biodiversity impacts and start gathering the data needed to implement mitigation actions and set reliable targets. Once a company can respond to all Level I EQs, engagement can move to subsequent levels, focusing on ambitions, targets, and mitigation actions. However, it is crucial to first establish a strong understanding of biodiversity impacts before advancing. In this way, INFORM can be used as a process to identify gaps in current business practices and priorities to increase awareness. After engaging with companies, investors should support the company to take necessary steps to build awareness and gather the necessary data to implement mitigation action

Below are specific practical suggestions for entry-level users to facilitate engagement with companies. A suggestion is to bring this page to engagement talks to ensure the conversation stays focused on information that is essential to make companies more aware of their biodiversity impacts.

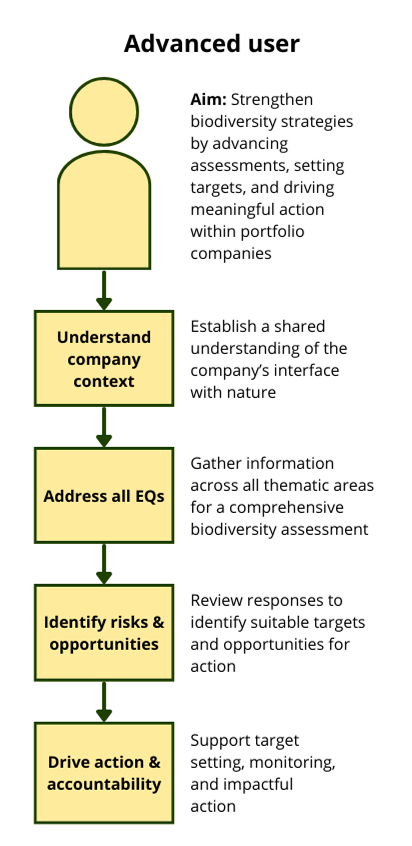

7. Engagement Process: Advanced User

If you have experience working with sustainability issues yourself, or if you work with companies that are mature in their sustainability work and disclosure, you will benefit from using the engagement questions across all levels of the INFORM hierarchy.

Many companies tend to have a negative impact on biodiversity, but this assumption may not be as consistent across companies with advanced biodiversity knowledge (or for new ventures explicitly providing sustainability solutions). Therefore, engagement should start by establishing a shared understanding of the company’s current interface with nature, and what strategies they have in place that are important to their biodiversity impact (Figure 5).

Figure 5. Engagement process for advanced users.

The aim of advanced biodiversity engagement is thus to use the engagement questions to assess the company’s current interface with nature and identify what actions and targets should be adopted to advance biodiversity action and minimize negative impacts. All INFORM engagement questions cover elements that are important for a comprehensive assessment of a company’s biodiversity impacts and should be addressed by a company with advanced biodiversity knowledge. However, it is essential that companies can first address the lower-level questions to have the necessary information to implement mitigation action and set targets. By mapping out all the responses, you get an overview of the company’s impact awareness and can assess its performance across the different levels and thematic areas. In this way, the question sheet can be used to identify gaps in the company’s current operations, and priorities to advance biodiversity action.

Below we provide specific tips for how INFORM can be used and what advanced users should think about when implementing it.

8. FAQ

What does INFORM do?

INFORM provides guidance through a structured process of engagement questions, across four thematic areas of relevance for nature and biodiversity impacts and risks. By using these questions as a foundation when engaging on biodiversity, investors can identify what information or action they should request from the company to reduce impacts. They can also assess the maturity of the company in nature and biodiversity-related issues and support them in adopting business practices that align with the Global Biodiversity Framework and global reporting standards.

How is INFORM different from existing initiatives and frameworks to guide active ownership?

Other initiatives and frameworks tend to focus on higher-level issues and assess what commitments and goals the company has set. INFORM complements these by focusing on measures of impact and data that are essential to reliably assess and track progress towards targets.

Why should an investor use INFORM?

Investors that want to support their assets in becoming more aware of their nature-related impacts and risks, and take action to mitigate biodiversity loss can use INFORM as scientifically grounded guidance. The engagement questions focus on tangible measurements of impact, actions, and targets that investors should encourage companies to adopt. Additionally, the questions help companies gather information and data for reporting that is requested under current standards and frameworks. Finally, engaging with INFORM builds the competency of both investors and companies to better understand how their operations relate to nature-related risks.

What reporting frameworks and standards does INFORM link to?

There are several mandatory and voluntary frameworks and standards for companies to disclose non-financial sustainability information. INFORM has been mapped to TNFD, GRI, ESRS*, and to globally agreed upon targets on biodiversity (GBF).

All engagement questions indicate which standards and reporting requirement they are linked to. In other words, it shows which reporting requirements a company will be compliant with if they provide information in response to the questions outlined in the guidance material. This alignment can help reduce reporting time and costs for companies and, over time, contribute to reducing nature-related risks to both companies and investors.

*refers to pre-omnibus requirements

What is GBF and why is it important to be aware of?

The Global Biodiversity Framework (GBF), adopted under the Convention on Biological Diversity, sets ambitious targets for halting biodiversity loss by 2030. These include protecting 30% of land and sea areas, reducing pollution, halting species extinction, and transforming food systems. INFORM is designed to help align business practices and investments with the GBF’s targets and provide a science-based roadmap for investors to engage with portfolio companies.

Target 15A of the GBF states that businesses should: “[r]egularly monitor, assess, and transparently disclose their risks, dependencies and impacts on biodiversity, 8. FAQ 17 including with requirements for all large as well as transnational companies and financial institutions along their operations, supply and value chains and portfolios.”

Our aim is to provide an accessible framework for investors to monitor and assess portfolio companies’ environmental performance, based on the GBF and other relevant indicators. All GBF targets that focus on reducing risks to biodiversity (target 1-8) are covered by the engagement questions in this framework. This alignment should reduce reporting time and costs for companies and, over time, contribute to reducing nature-related risks to both companies and investors.

- Steffen, W. et al. (2015). Planetary boundaries: Guiding human development on a changing planet. Science, 347,1259855. ↩︎

- Rumohr, Q. et al. (2023). Drivers and pressures behind insect decline in Central and Western Europe based on long-term monitoring data. PLoS ONE, 18(8): e0289565. ↩︎

- Potts, S., et al. (2015). Status and trends of European pollinators. Key findings of the STEP project. ↩︎

- NOAA National Centers for Environmental Information (2025). Monthly Global Climate Report for Annual 2024. Available at: https://www.ncei.noaa.gov/access/monitoring/monthly-report/global/202413 ↩︎

- European Environment Agency (2024). European Climate Risk Assessment. EEA, Luxembourg. ↩︎

- Wassénius, E., Crona, B., & Quahe, S. (2024). Essential environmental impact variables: A means for transparent corporate sustainability reporting aligned with planetary boundaries. One Earth, 7(2), 211–225. ↩︎