For the financial sector to become nature-positive new techniques for identifying business models that safeguard, enhance and integrate biodiversity need to be developed.

The two complementary overarching goals of ‘greening finance and financing green’ – stated by the World Bank – require implementation strategies that reflect the capacities of investors to influence biodiversity outcomes.

MISTRA Finance to Revive Biodiversity (FinBio) is a partnership between academic and financial actors to create a platform designed for real-world impact.

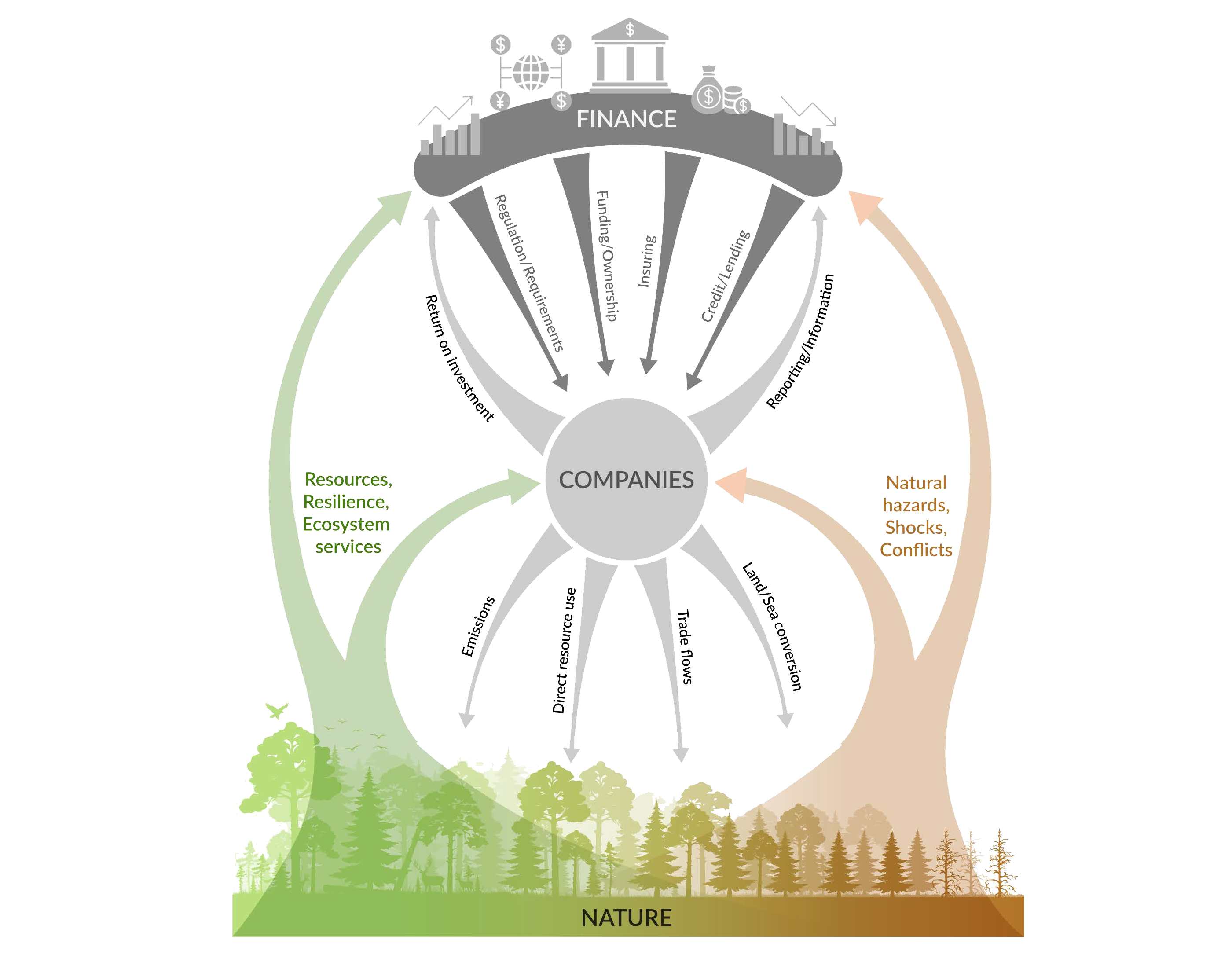

The financial system depends on and impacts nature through its relationship to companies and how they are able to act. Nature underpins the economy and the financial system as it provides resilience, resources and ecosystem services. The loss of nature and biodiversity is a threat to the economy and financial actors as risks of natural hazards, shocks and conflicts increase, while resilience is eroded. Finance has the responsibility and opportunity to understand this dependency and impact, and to steer its activities to support regeneration and protection of nature and biodiversity. Mistra FinBio positions itself to bring light to these connections and to develop actionable tools to guide a green development for finance sector actors.

We work in four core themes: